Shares of Qualcomm (NASDAQ: QCOM) and Intel (NASDAQ: INTC) have been heading in reverse instructions this yr, which can appear a bit stunning at first provided that each chipmakers have been going through headwinds of their core markets and have been counting on the proliferation of synthetic intelligence (AI) to show their fortunes round.

While Intel’s enterprise has been harm lately due to a decline in gross sales of private computer systems (PCs), Qualcomm has been struggling on account of tepid smartphone gross sales. Both of those finish markets are anticipated to profit huge time from AI adoption. However, Qualcomm’s 19% positive factors and Intel’s 23% slide on the inventory market in 2024 point out that the previous might be faring higher so far as capitalizing on the AI catalyst is worried.

Let’s see if that is certainly the case, and if Qualcomm is the higher AI decide of the 2.

The case for Qualcomm

The smartphone market is ready for a turnaround this yr, and analysts predict one thing just like occur at Qualcomm. The chipmaker’s income in fiscal 2023 (which ended on Sept. 24, 2023) fell 19% from the earlier yr to $35.8 billion, whereas adjusted earnings declined 33% to $8.43 per share. That wasn’t stunning, as smartphone shipments fell an estimated 3.2% in 2023 as per IDC, following a a lot bigger decline of 11.3% in 2022.

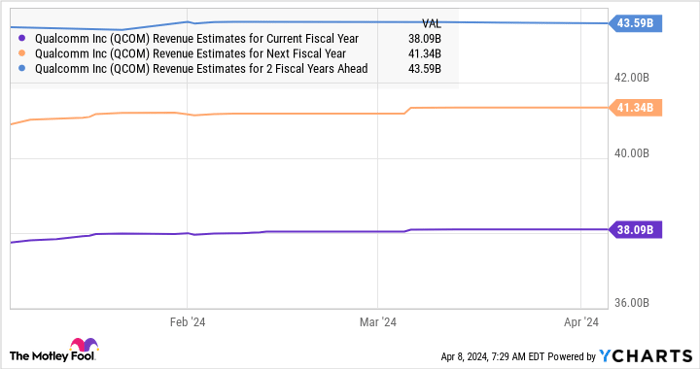

This yr, nevertheless, analysts predict Qualcomm’s income to go increased, adopted by additional positive factors within the subsequent couple of fiscal years. This is clear from the next chart:

QCOM Revenue Estimates for Current Fiscal Year knowledge by YCharts

The progress of AI-enabled smartphones goes to play a key position in Qualcomm’s turnaround. Market analysis agency IDC is forecasting that 170 million AI-enabled smartphones could possibly be shipped this yr, greater than triple final yr’s shipments of 51 million models. More importantly, IDC factors out that AI smartphones would account for 15% of the general smartphone market this yr, indicating that they nonetheless have a whole lot of room for progress sooner or later.

Even higher, the AI smartphone market is anticipated to clock an annual progress fee of 83% from 2024 to 2027. Qualcomm is in a pleasant place to capitalize on this area, because it provides processors to prime smartphone OEMs (authentic tools producers) akin to Apple and Samsung. Qualcomm’s Snapdragon processors are powering the AI options on Samsung’s newest Galaxy S24 flagship smartphones, and it’s trying to push the envelope additional with a brand new chip to focus on mid-range smartphones.

It is value noting that market analysis agency Counterpoint Research expects Qualcomm to seize greater than 80% of the generative AI smartphone market over the subsequent couple of years. That would not be stunning contemplating the tempo that Qualcomm has set on this market already by touchdown flagship prospects akin to Samsung.

What’s extra, Qualcomm has set its sights on the AI PC market as effectively, which might open a brand new alternative for the corporate to develop its enterprise sooner or later. As such, Qualcomm appears effectively positioned to capitalize on a few fast-growing AI-related alternatives, which explains why this chip inventory has been heading increased this yr.

The case for Intel

Things have gone from dangerous to worse for Intel because the yr has progressed. The firm began 2024 with a better-than-expected earnings report for the fourth quarter of 2023, however it failed to supply a strong outlook. Intel’s steerage for the primary quarter of 2024 was considerably behind expectations, which is why buyers pressed the panic button. Intel obtained one other blow after it emerged that its foundry unit is incurring big losses.

As far as the corporate’s AI efforts are involved, administration identified on the January earnings convention name that its income pipeline from AI accelerators is now greater than $2 billion. The firm claims to have shored up its provide chain “to support the growing customer demand and we expect meaningful revenue acceleration throughout the year.”

However, as Intel is anticipated to ship $57.4 billion in complete income this yr as per consensus estimates, the $2 billion income pipeline signifies that AI is not going to maneuver the needle in a major means for the corporate. On the opposite hand, Chipzilla faces stiff competitors from AMD available in the market for AI PC processors. AMD CEO Lisa Su claims that the corporate’s Ryzen processors are powering greater than 90% of the AI PCs which might be presently available in the market.

This in all probability explains why AMD’s income from the shopper enterprise grew at a a lot sooner tempo in comparison with Intel’s within the earlier quarter. More particularly, Intel’s shopper computing group income of $8.8 billion was up 33% yr over yr in This fall 2023. AMD, then again, recorded 62% year-over-year progress in its shopper section income in the identical interval.

With AMD stealing market share from Intel within the PC market due to AI-enabled PCs, and Qualcomm trying to reduce its enamel on this market as effectively, Chipzilla might discover it troublesome to take advantage of the rising adoption of AI.

The verdict

It is clear that Qualcomm is best positioned to capitalize on the AI alternative due to the strong share it’s anticipated to command in AI smartphones. Intel, in the meantime, has a whole lot of catching as much as do available in the market for each AI knowledge heart chips and PCs. Moreover, Intel is pricey when in comparison with Qualcomm, with a trailing price-to-earnings (P/E) ratio of 110. Qualcomm is less expensive with a P/E ratio of 24.

Also, Qualcomm’s ahead P/E of 18 is decrease than Intel’s a number of of 33. Investors are getting a greater deal on Qualcomm proper now, which is why they could wish to think about shopping for this AI inventory over Intel earlier than it jumps increased following its strong begin to 2024.

Should you make investments $1,000 in Qualcomm proper now?

Before you purchase inventory in Qualcomm, think about this:

The Motley Fool Stock Advisor analyst group simply recognized what they consider are the 10 finest shares for buyers to purchase now… and Qualcomm wasn’t one in every of them. The 10 shares that made the reduce might produce monster returns within the coming years.

Stock Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Stock Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 8, 2024

Harsh Chauhan has no place in any of the shares talked about. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, and Qualcomm. The Motley Fool recommends Intel and recommends the next choices: lengthy January 2023 $57.50 calls on Intel, lengthy January 2025 $45 calls on Intel, and brief May 2024 $47 calls on Intel. The Motley Fool has a disclosure coverage.